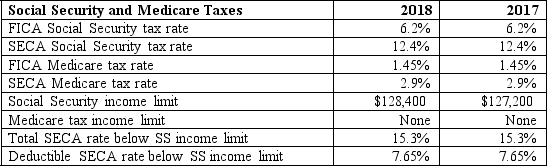

Warren has $62,400 of net income from his sole proprietorship. How much is his self-employment tax on this income in 2018?

Definitions:

Operating Expenses

Costs associated with the normal operations of a business, including sales and marketing, research and development, and administrative expenses.

Indirect Method

A way of reporting cash flows from operating activities by adjusting net income for non-cash transactions and changes in working capital.

Net Income

The profit of a company after all expenses and taxes have been subtracted from total revenue.

Operating Activities

Transactions and other events related to the core business operations of a company, including revenue and expense transactions that affect the net income.

Q17: Cindy has taxable income of $67,000 excluding

Q19: A cash basis taxpayer recognizes an expense

Q24: Which of the following are included in

Q27: Allison Corporation (marginal tax rate of 21%)

Q29: Windjammer Corporation, a cash-basis, calendar-year corporation sold

Q66: Charles has gross income of $80,000 and

Q87: Sebastian (age 46) and Kaitlin (age 45)

Q92: Up to 85 percent of a person's

Q95: Explain the two acceptable methods for recognizing

Q103: Which of the following is true regarding