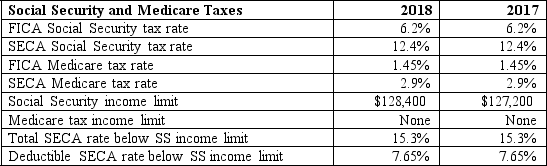

Jose worked at an architectural firm as an employee for the first four months of 2018 before he established his own business. He earned $53,300 at the architectural firm. His net income from his sole proprietorship was $78,000. Determine Jose's self-employment tax for 2018.

Definitions:

Fabricating Department

A section within a manufacturing company where raw materials are transformed into components or products through various processes like cutting, welding, and assembly.

Production Requirements

The specific criteria or conditions needed to manufacture or produce goods, including materials, labor, and technology.

Regular Machines

Standardized machines typically used in manufacturing or production processes with specific, repetitive tasks.

Production Time

The total time required to manufacture an item, including processing, waiting, and assembly times.

Q9: For 2018-2025, the personal and dependency exemption

Q20: Sarah and Jason are married and live

Q25: Marcia and Tim, a married couple, file

Q26: Over half of the people who live

Q47: Which of the following is not included

Q64: Carl, age 42, is married and has

Q78: In what order are capital gains subject

Q101: A nonresident alien can only file a

Q117: George (49) and Jean (36), a married

Q129: Jabo Corporation has its home office and