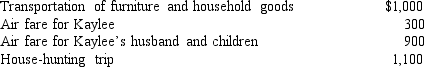

Kaylee is a member of the U.S. Armed Forces on active duty who moved because of a permanent change in station. She incurred the following moving expenses:  Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

Kaylee's employer reimburses her $3,300 for the above expenses. Assuming that Kaylee meets all other requirements, how much income does Kaylee have as a result of this reimbursement of her moving expenses?

Definitions:

Stroop Effect

A demonstration of cognitive interference where the brain's reaction time slows down when processing conflicting information, such as reading the word "green" printed in red color.

Algorithms

Procedures or formulas for solving problems, often used in mathematics and computer science to perform specific tasks or calculations.

Overconfident

A psychological state characterized by an individual's unwarranted belief in their own abilities or the accuracy of their knowledge, often leading to risk-taking behaviors.

Base-Rate Information

Statistical information about the frequency of events or characteristics within a given population.

Q2: John and Mary have three children: Aaron

Q11: Taxpayer B has the following gains and

Q31: Jury trials are only available in<br>A) Court

Q54: What is Cheryl's AGI if she has

Q70: Which of the following is a tax?<br>A)

Q70: Carbon Corporation had a $2,000,000 contract to

Q74: Nicholas wanted to take an important customer

Q78: The mid-year and mid-month are acceptable conventions

Q91: Which of the following types of taxes

Q104: Which of the following is not required