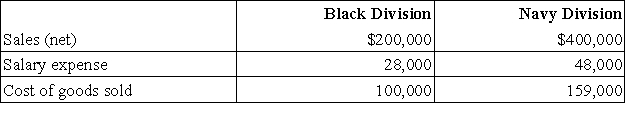

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

Definitions:

Payroll Tax

Assessments required from employers or their employees, usually expressed as a percentage of the remuneration that staff earn.

Federal Income Taxes

Taxes levied by the national government on individual and business earnings.

Married Couple

A legally recognized union between two individuals, typically involving a public declaration of commitment.

Transfer Payments

Payments made by governments to individuals or other sectors in the economy, typically without any goods or services being received in return.

Q4: Overall population prevalence of psychiatric illness in

Q11: According to the 1978 WHO Alma Ata

Q24: With respect to cycle time,companies strive to

Q36: Sanchez Company's output for the current period

Q42: Widmer Corp.requires a minimum $10,000 cash balance.If

Q60: A college uses advisors who work with

Q73: _ is the process of analyzing alternative

Q77: When the amount invested differs substantially across

Q122: Vextra Corporation is considering the purchase of

Q129: A cost that changes in proportion to