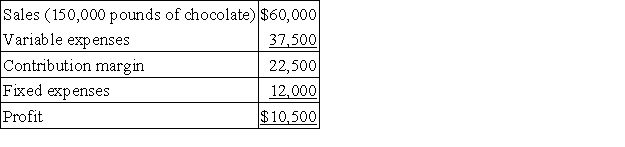

The Dark Chocolate Division of Yummy Snacks,Inc.had the following operating results last year:  Dark Chocolate expects identical operating results this year.The Dark Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.Assume that the Peanut Butter Division of Yummy Snacks wants to purchase an additional 20,000 pounds of chocolate from the Dark Chocolate Division.Assume that the Dark Chocolate Division is currently operating at its capacity of 200,000 pounds of chocolate.Also assume again that the Peanut Butter Division wants to purchase an additional 20,000 pounds of chocolate from Dark Chocolate.Under these conditions,what amount per pound of chocolate would Dark Chocolate have to charge Peanut Butter in order to maintain its current profit?

Dark Chocolate expects identical operating results this year.The Dark Chocolate Division has the ability to produce and sell 200,000 pounds of chocolate annually.Assume that the Peanut Butter Division of Yummy Snacks wants to purchase an additional 20,000 pounds of chocolate from the Dark Chocolate Division.Assume that the Dark Chocolate Division is currently operating at its capacity of 200,000 pounds of chocolate.Also assume again that the Peanut Butter Division wants to purchase an additional 20,000 pounds of chocolate from Dark Chocolate.Under these conditions,what amount per pound of chocolate would Dark Chocolate have to charge Peanut Butter in order to maintain its current profit?

Definitions:

Neurotransmitters

Chemical substances that transmit signals across a synapse from one neuron to another in the nervous system.

MAOIs

Short for Monoamine Oxidase Inhibitors, a class of antidepressant drugs that work by inhibiting the enzyme responsible for breaking down neurotransmitters such as serotonin and norepinephrine.

Restricted Diet

A diet that limits or eliminates certain foods or nutrients, often for medical or health reasons.

High Blood Pressure

A condition in which the force of the blood against the walls of the arteries is consistently too high, leading to health risks.

Q64: A company can buy a machine that

Q74: A(n)_ arises from a past decision and

Q79: Fixed budget performance reports compare actual results

Q81: Flagstaff Company has budgeted production units of

Q111: Granfield Company is considering eliminating its backpack

Q122: Vextra Corporation is considering the purchase of

Q125: An opportunity cost is the potential benefit

Q143: Georgia Inc. ,has collected the following data

Q157: If two projects have the same risks,the

Q169: Georgia,Inc.has collected the following data on one