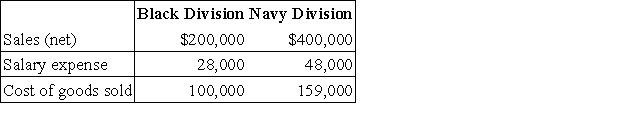

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute gross profit for the Black and Navy Divisions,respectively.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute gross profit for the Black and Navy Divisions,respectively.

Definitions:

Direct Labor Cost

The expense related to the work of employees directly involved in the production of goods or services, such as wages for assembly line workers.

Direct Labor-Hours

Direct labor-hours are the total number of hours worked by employees directly involved in the manufacturing process, used as a basis for assigning labor costs to products.

Direct Materials

Raw materials that can be directly identified with the production of specific goods or services and are a major component of product costs.

Budgeted Production

The planned level of production output, calculated based on demand forecasts and inventory requirements.

Q1: Which of the following is a central

Q7: A plan that states the number of

Q16: Aquaculture fish farming) has now reached what

Q20: Flagstaff Company has budgeted production units of

Q22: Capital budgeting decisions are generally based on:<br>A)Tentative

Q28: Kragle Corporation reported the following financial data

Q49: Elliot Company can sell all of its

Q65: The method most likely to produce the

Q112: Indirect expenses are allocated to departments based

Q148: Whidbey Co.fixed budget for the year is