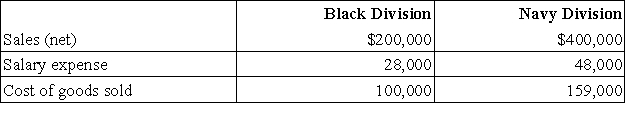

Marian Corporation has two separate divisions that operate as profit centers.The following information is available for the most recent year:  The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

The Black Division occupies 20,000 square feet in the plant.The Navy Division occupies 30,000 square feet.Rent is an indirect expense and is allocated based on square footage.Rent expense for the year was $50,000.Compute departmental income for the Black and Navy Divisions,respectively.

Definitions:

Benefits Principle

A taxation principle that states those who benefit from government services should pay in proportion to the amount they benefit.

Taxation

The system through which governments impose financial charges on citizens or corporates to fund public spending.

Tax Incidence

The study of the effect of a particular tax on the distribution of economic welfare, focusing on who ultimately pays the tax (the burden of the tax).

Consumers

Individuals or groups that purchase goods and services for personal use and are the end users in the distribution chain.

Q9: The shift from the second to third

Q14: Which of the following new technologies is

Q29: During its most recent fiscal year,Dover,Inc.had total

Q42: Widmer Corp.requires a minimum $10,000 cash balance.If

Q78: Spilker Linens Store has three departments: Bath,Kitchen,and

Q83: Investment center managers are usually evaluated using

Q108: A graphic depiction of the break-even point

Q110: A cost center does not directly generate

Q113: Milltown Company specializes in selling used cars.During

Q150: If budgeted beginning inventory is $8,300,budgeted ending