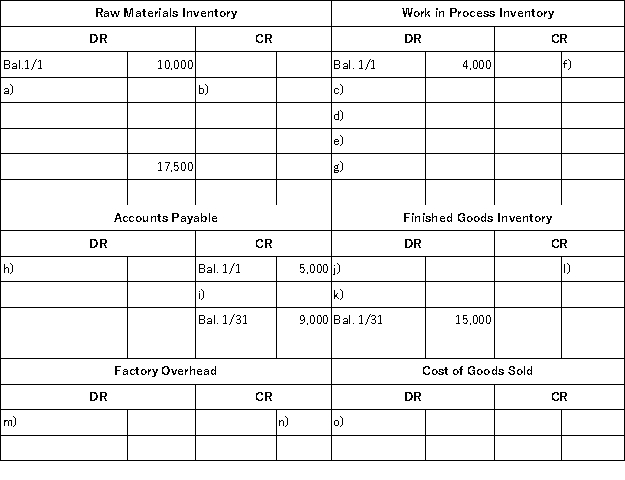

MOB Corp.maintains an internet-based general ledger.Overhead is applied on the basis of direct labor costs.Its bookkeeper accidentally deleted most of the entries that had been recorded for January.A printout of the general ledger (in T-account form)showed the following:  A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

A review of the prior year's financial statements,the current year's budget,and January's source documents produced the following information:

(1)Accounts Payable is used for raw material purchases only.January purchases were $49,000.

(2)Factory overhead costs for January were $17,000 none of which is indirect materials.

(3)The January 1 balance for finished goods inventory was $10,000.

(4)There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5)Total cost of goods manufactured for January was $90,000.

(6)All direct laborers earn the same rate ($13/hour).During January,2,500 direct labor hours were worked.

(7)The predetermined overhead rate is based on direct labor costs.Budgeted (expected)overhead for the year is $195,000 and budgeted (expected)direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Definitions:

Rational Way

Approaching situations and problem-solving based on logical reasoning, facts, and systematic thought processes.

Unconscious Processes

Mental activities outside of conscious awareness, influencing thoughts, feelings, and behaviors according to psychoanalytic theory.

Self-actualization

Attaining one's full talents and possibilities, regarded as an innate desire or motivation present in all individuals.

Self-concept

is the mental and conceptual understanding and persistent view individuals hold about themselves, their abilities, and their characteristics.

Q8: A _ contains features of both process

Q48: Managerial accounting provides financial and nonfinancial information

Q65: The rate established prior to the beginning

Q91: In a process costing system,direct material costs

Q111: Which of the following characteristics applies to

Q126: The cash flow on total assets ratio

Q127: Three important assumptions in cost-volume-profit analysis is

Q130: General-purpose financial statements include the (1)income statement,

Q141: Job order production systems would be appropriate

Q192: Current information for the Healey Company follows: