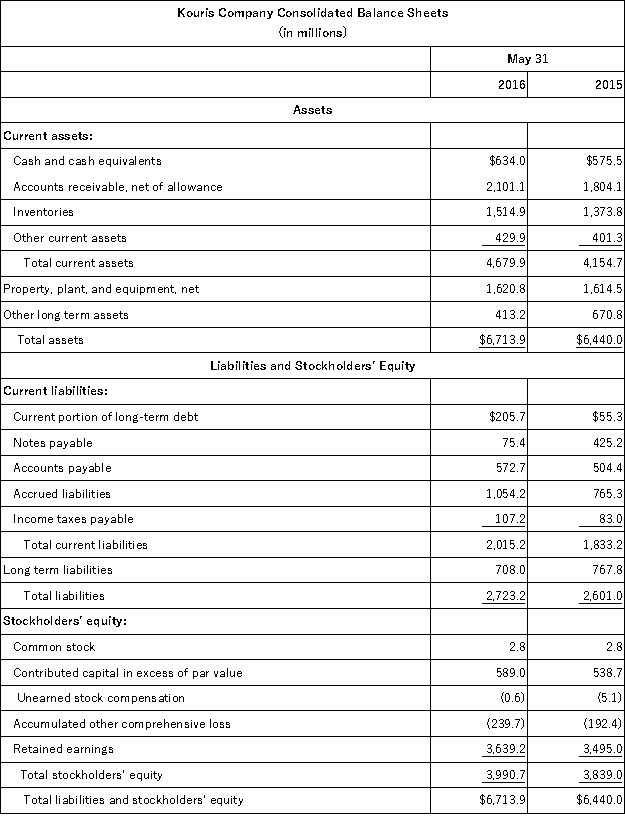

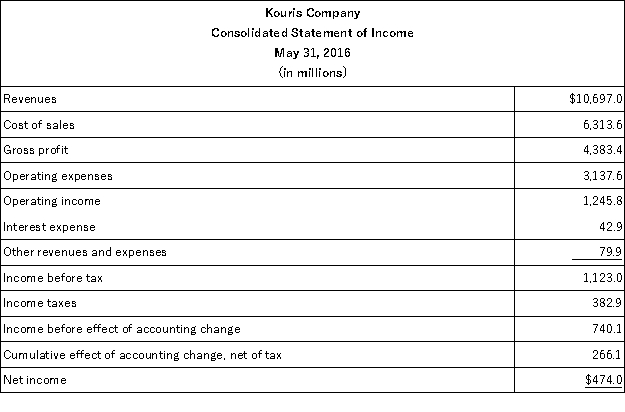

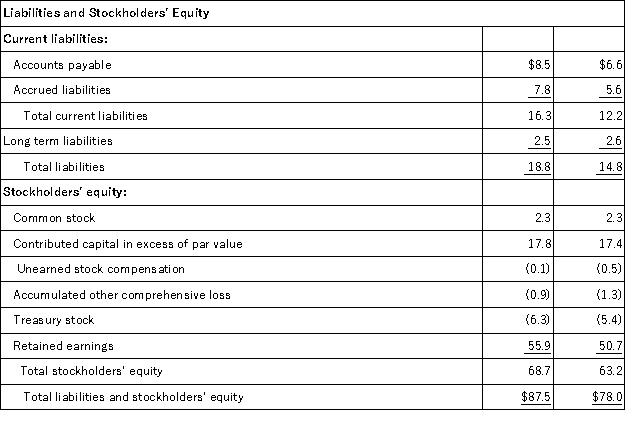

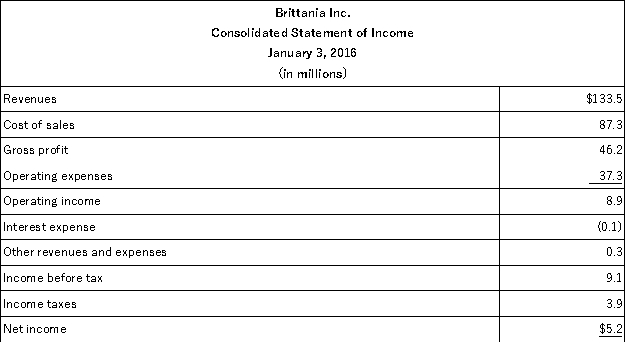

The following summaries from the income statements and balance sheets of Kouris Company and Brittania,Inc.are presented below.

(1)For both companies for 2016,compute the:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies for 2016,compute the:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Definitions:

Perfect Competitor

An individual or company within a perfectly competitive market that cannot influence the market price and must accept the prevailing market price.

Long Run

In economics, a period in which all inputs and outputs can be varied, allowing for the adjustment of all factors of production.

Perfect Competitor

A theoretical market where no individual buyer or seller has the power to affect the price of goods, leading to an optimal allocation of resources.

Long Run

A period in economics sufficient for all markets to adjust, including prices, outputs, and wages, reflecting changes in economic conditions or policies.

Q7: Just-in-time manufacturing is a system that acquires

Q21: A company had net cash flows from

Q55: Information for the Deuce Manufacturing Company follows.Compute

Q70: Using the information below,compute the Days' sales

Q140: A company had net income of $86,000

Q149: _ activities generally include those transactions and

Q156: _ financial statements show the financial position,results

Q158: Refer to the following selected financial information

Q161: Manufacturing costs other than direct materials and

Q170: Long-term investments include investments in land or