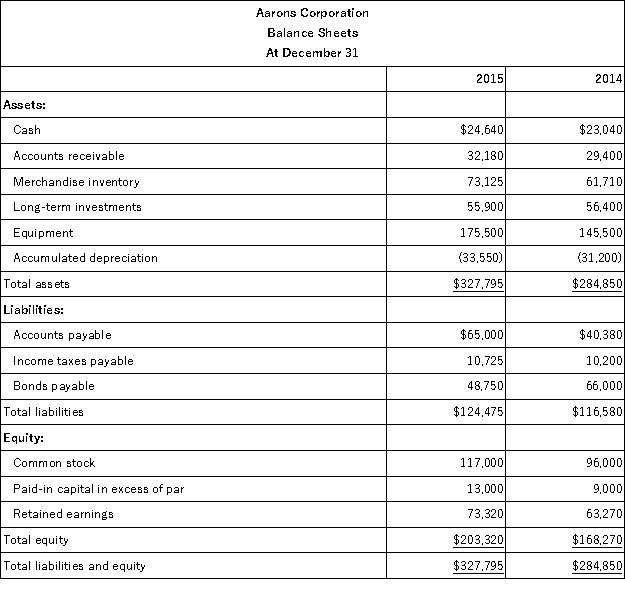

The following information is available for the Aarons Corporation:

Additional information:

Additional information:

(1)There was no gain or loss on the sales of the long-term investments,nor on the bonds retired.

(2)Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3)New equipment was purchased for $67,550 cash.

(4)Cash dividends of $33,600 were paid.

(5)Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for calendar-year 2015 using the indirect method.

Definitions:

Erosion

The process by which natural forces remove soil, rock, or dissolved material from one location and transport it to another.

Phytoremediation

The use of plants to remove, detoxify, or immobilize environmental contaminants in soil or water through natural processes.

Translocation

In genetics, structural rearrangement in which a broken piece of chromosome has become reattached in the wrong location. In plants, movement of organic compounds through phloem.

Casparian Strip

Waxy band between the plasma membranes of abutting root endodermal cells; forms a seal that prevents soil water from seeping through cell walls into the vascular cylinder.

Q11: The reporting of net cash provided or

Q24: When using the equity method for investments

Q36: All of the following statements regarding a

Q50: Which of the following transactions or events

Q72: Which one of the following is representative

Q83: Jenny,an employee of Toucan Company,used company assets

Q109: In the current year,Logic Co.purchased bonds of

Q117: A common focus of financial statement users

Q134: Long-term investments in debt securities not classified

Q149: Selected balances from a company's financial statements