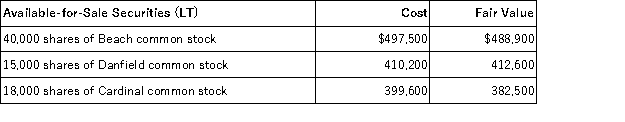

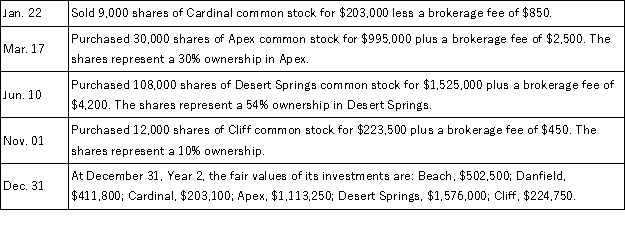

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction, (1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities, (2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in available-for-sale securities, (3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

Definitions:

Logistic Regression

A statistical method for analyzing datasets in which there are one or more independent variables that determine an outcome, which is dichotomous.

Multiple Logistic Regression

A statistical technique that models the probability of a certain outcome or event based on more than one independent variable.

Explanatory Variables

Variables in a statistical model that are believed to explain or influence changes in a response variable.

Standard Deviation

A measure of the dispersion or variability within a set of data points, indicating how spread out the values are from the mean.

Q16: A premium reduces the interest expense of

Q28: On September 20,Fletcher Corporation issued 25,000 shares

Q60: Zhang Company reported Cost of goods sold

Q138: Based on the following information provided about

Q147: J.P.Industries purchased 2,000 shares of Yang's common

Q150: The total amount of cash and other

Q153: A company received cash proceeds of $206,948

Q155: The direct method for the preparation of

Q172: A liability for dividends exists:<br>A)When cumulative preferred

Q202: Changes in accounting estimates are:<br>A)Considered accounting errors.<br>B)Reported