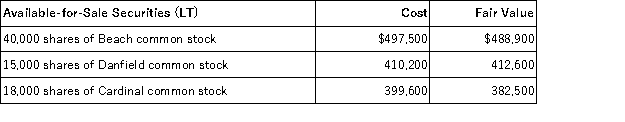

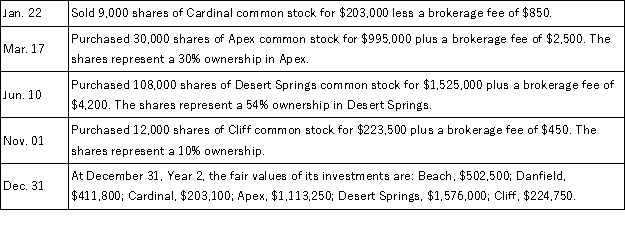

Weston Company had the following long-term available-for-sale securities in its portfolio at December 31,Year 1.Weston had several long-term investment transactions during the next year.After analyzing the effects of each transaction, (1)determine the amount Weston should report on its December 31,Year 1 balance sheet for its long-term investments in available-for-sale securities, (2)determine the amount Weston should report on its December 31,Year 2 balance sheet for its long-term investments in available-for-sale securities, (3)prepare the necessary adjusting entry to record the fair value adjustment at December 31,Year 2.

Definitions:

Hypothesis

A proposed explanation or prediction about a phenomenon that can be tested through research and experimentation.

Sales Dollars

The total revenue generated from sales, expressed in dollars.

One-tailed T-test

A statistical test used to determine if a sample mean significantly exceeds or is significantly less than a hypothesized value.

Mean Rating

The average score derived from the sum of all ratings divided by the number of ratings.

Q37: The following information is available on PDC

Q39: Investments in trading securities are accounted for

Q43: The comparison of a company's financial condition

Q50: _ bonds are bonds that mature at

Q53: Common-size statements:<br>A)Reveal changes in the relative importance

Q70: A company received dividends of $0.35 per

Q71: A rough guideline states that for a

Q161: The gross margin ratio,return on total assets,and

Q162: The appropriate section in the statement of

Q176: The cash flow on total assets ratio