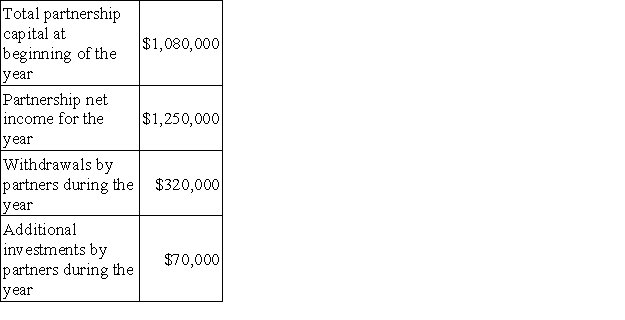

The following information is available on PDC Enterprises,a partnership,for the most recent fiscal year:  There are three partners in TGR Enterprises: Pearson,Darling and Cathay.At the end of the year,the partners' capital accounts were in the ratio of 2:2:1,respectively.Compute the ending capital balances of Cathay.

There are three partners in TGR Enterprises: Pearson,Darling and Cathay.At the end of the year,the partners' capital accounts were in the ratio of 2:2:1,respectively.Compute the ending capital balances of Cathay.

Definitions:

Q20: When convertible bonds are converted to a

Q20: Glade,Marker,and Walters are partners with beginning-year capital

Q32: On August 1,a company's board of directors

Q59: Mayan Company had net income of $132,000.The

Q80: Stockholders' equity consists of paid-in capital and

Q98: FICA taxes include:<br>A)Social Security and Medicare taxes.<br>B)Charitable

Q115: Stated value stock is no-par stock that

Q126: Palmer withdraws from the FAP Partnership.The remaining

Q132: Masters,Hardy,and Rowen are dissolving their partnership.Their partnership

Q204: Dividing stockholders' equity applicable to common shares