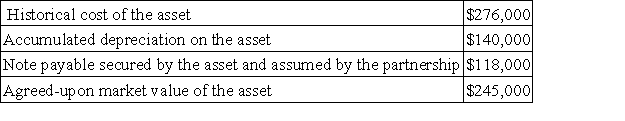

Dalworth and Minor have decided to form a partnership.Minor is going to contribute a depreciable asset to the partnership as her equity contribution to the partnership.The following information regarding the asset to be contributed by Minor is available:  Based on this information,Minor's beginning equity balance in the partnership will be:

Based on this information,Minor's beginning equity balance in the partnership will be:

Definitions:

Net Investment Income

The income received from investment assets (like stocks, bonds, mutual funds) after deducting related expenses.

Surtax

An additional tax levied on top of the base tax liability; often applied to income exceeding a certain threshold.

Tax Rates

The percentage at which an individual or corporation is taxed, varying based on income level.

Long-term Capital Gains

Profits from the sale of an asset held for more than a year, generally taxed at a lower rate than short-term capital gains or regular income.

Q3: At least one partner having a debit

Q23: General Co.entered into the following transactions involving

Q34: A company issued 10-year,9% bonds with a

Q47: Banks authorized to accept deposits of amounts

Q49: When one company owns more than 50%

Q62: Organization expenses of a corporation often include

Q83: Wheadon,Davis,and Singer formed a partnership with Wheadon

Q95: A company sells tablet computers for $1,300

Q121: Cumulative preferred stock has a right to

Q133: The contract rate of interest is the