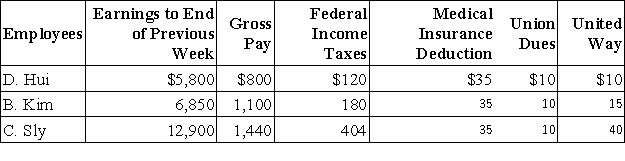

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Definitions:

Abstract Theory

A theoretical proposal that focuses on general principles and ideas rather than practical applications or concrete examples.

Local Schools

Educational institutions situated within a specific geographical area, serving the community's residents.

Comparative Case Studies

Research method involving detailed and systematic comparisons of cases (events, processes, organizations, etc.) to understand their similarities and differences.

Multiple-case Studies

Research approach involving the detailed and in-depth examination of several cases within a real-world context to understand a broader issue.

Q43: Partners' withdrawals of assets are:<br>A)Credited to their

Q47: Prior to June 30,a company has never

Q55: A company wants to decrease its $200

Q75: On January 1,Year 1 Cleaver Company borrowed

Q84: Each December 31,Kimura Company ages its accounts

Q98: The voucher system of control:<br>A)Is a set

Q112: The interest accrued on $7,500 at 6%

Q119: On August 25,Barrymore Co.purchased $5,000 worth of

Q148: An employer's federal unemployment taxes (FUTA)are reported:<br>A)Annually.<br>B)Semiannually.<br>C)Quarterly.<br>D)Monthly.<br>E)Weekly.

Q193: Recording of a stock dividend results in