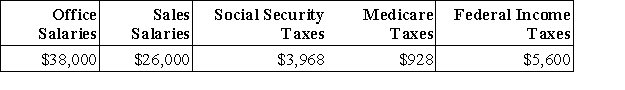

Deacon Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.  a.Recorded the May payroll using the payroll register information given above.

a.Recorded the May payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the May payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is 0.6%.

c.Issued a check to Reliant Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Reliant Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,020.

Definitions:

Q20: A properly designed internal control system:<br>A)Lowers the

Q36: On February 1,a customer's account balance of

Q36: In closing the accounts at the end

Q66: The accounts receivable ledger:<br>A)Is a substitute for

Q71: A leasehold is:<br>A)A short-term rental agreement.<br>B)The same

Q97: The following information is available on TGR

Q110: Following are seven items a through g

Q131: A _ is a report explaining any

Q143: A reverse stock split increases the market

Q145: An employer has an employee benefit package