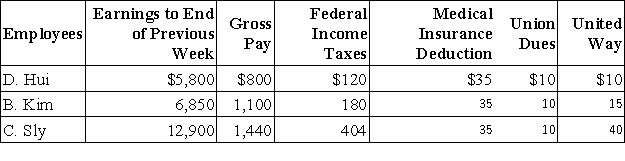

The payroll records of a company provided the following data for the current weekly pay period ended March 12.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $117,000 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period.The federal and state unemployment tax rates are 0.8% and 5.4%,respectively,on the first $7,000 paid to each employee.Calculate the net pay for each employee.

Definitions:

Duty to Reimburse

The obligation to pay back or compensate another party for expenses, losses, or damages incurred on one's behalf.

Authorized Expenditure

An approved expense deemed necessary and reasonable for the operation or management of a business or organization.

Express Authority

The power granted to an agent or representative by clear and explicit instructions from the principal.

Conflict of Interest

A situation in which a person's personal interests could potentially influence their professional duties or decisions.

Q10: An _ is an obligation requiring a

Q11: Wright,Bell,and Edison are partners and share income

Q23: General Co.entered into the following transactions involving

Q24: Eastline Corporation had 10,000 shares of $10

Q41: In many states,the minimum amount that stockholders

Q55: A company purchased and installed machinery on

Q69: The Accounts Payable controlling account:<br>A)Is not included

Q83: The current FUTA tax rate is 0.6%,and

Q110: A company's employees had the following earnings

Q175: Preferred stock with a feature allowing preferred