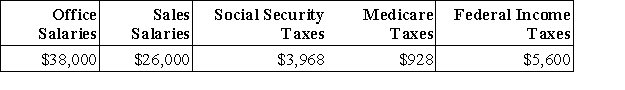

Deacon Company provides you with following information related to payroll transactions for the month of May.Prepare journal entries to record the transactions for May.  a.Recorded the May payroll using the payroll register information given above.

a.Recorded the May payroll using the payroll register information given above.

b.Recorded the employer's payroll taxes resulting from the May payroll.The company had a merit rating that reduces its state unemployment tax rate to 3.5% of the first $7,000 paid each employee.Only $42,000 of the current months salaries are subject to unemployment taxes.The federal rate is 0.6%.

c.Issued a check to Reliant Bank in payment of the May FICA and employee taxes.

d.Issued a check to the state for the payment of the SUTA taxes for the month of May.

e.Issued a check to Reliant Bank in payment of the employer's quarterly FUTA taxes for the first quarter in the amount of $1,020.

Definitions:

Timely Deposits

The IRS requirement that taxpayers must deposit certain types of taxes (e.g., payroll taxes) by specific deadlines to avoid penalties.

Form W-2

An IRS form used by employers to report annual wage and salary information for employees along with the amount of taxes withheld from their paychecks.

Social Security Administration

A U.S. government agency that administers social security, a social insurance program consisting of retirement, disability, and survivors benefits.

W-3 Transmittal Form

A tax form used by employers to report the total earnings, Social Security wages, Medicare wages, and withholding for all employees for a year.

Q6: Wheadon,Davis,and Singer formed a partnership with Wheadon

Q19: A company makes a payment of $5,000

Q33: Prior to June 30,a company has never

Q42: The price at which a share of

Q61: Granite Company purchased a machine costing $120,000,terms

Q74: _ includes currency,coins,and amounts on deposit in

Q77: Which of the following accounting principles prescribes

Q107: _ are amounts owed to suppliers for

Q132: A company paid $320,000 for equipment that

Q139: In order to be reported,liabilities must:<br>A)Be certain.<br>B)Sometimes