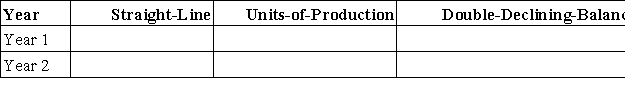

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000;Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Definitions:

Drive Axles

Components of a vehicle's drivetrain that transfer power from the transmission to the wheels, enabling motion.

Paccar

A global technology company known for designing, manufacturing, and providing customer support for high-quality light, medium, and heavy-duty trucks.

Truck Brand

A specific make or marque of trucks, distinguished by a unique name, symbol, or feature, associated with specific manufacturers.

Wide-Base Singles

Single, wide tires that are used in place of traditional dual tire configurations on commercial vehicles, offering benefits such as reduced weight and improved fuel efficiency.

Q14: Which of the following statements regarding accounting

Q17: At December 31,Yarrow Company reports the following

Q21: Total asset turnover is used to evaluate:<br>A)The

Q35: If a check correctly written and paid

Q47: McClintock Co.had the following transactions involving plant

Q83: Generally accepted accounting principles require that the

Q93: Owning a patent:<br>A)Gives the owner the exclusive

Q96: Under IFRS,the term provision:<br>A)Refers to expense.<br>B)Usually refers

Q110: The accounts receivable turnover is calculated by:<br>A)Dividing

Q138: A company sold $12,000 worth of bicycles