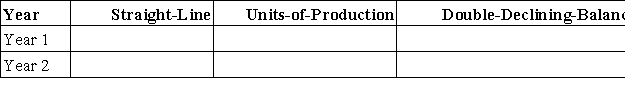

A machine costing $450,000 with a 4-year life and an estimated salvage value of $30,000 is installed by Peters Company on January 1.The company estimates the machine will produce 1,050,000 units of product during its life.It actually produces the following units for the first 2 years: Year 1,260,000;Year 2,275,000.Enter the depreciation amounts for years 1 and 2 in the table below for each depreciation method.Show calculation of amounts below the table.

Definitions:

Renewable Sources

Natural resources that can be replenished over short periods, such as solar, wind, and hydro energy.

Total Energy Production

The overall amount of energy generated by a country or region from various sources like fossil fuels, nuclear, and renewables.

Renewable Energy

refers to energy that is collected from renewable resources, which are naturally replenished on a human timescale, such as sunlight, wind, rain, tides, waves, and geothermal heat.

Environmental Sustainability

An approach to natural resource management that seeks to safeguard the environment and maintain ecological balance in the face of ongoing human activity and development.

Q4: Merchandise inventory includes:<br>A)All goods owned by a

Q14: Salvage value is:<br>A)Not a factor relevant to

Q19: On June 1,a company established a $75

Q82: The correct times interest earned computation is:<br>A)(Net

Q96: Under IFRS,the term provision:<br>A)Refers to expense.<br>B)Usually refers

Q97: A company has advance subscription sales totaling

Q101: _ are the part of the accounting

Q105: A company's old machine that cost $40,000

Q117: Land improvements are:<br>A)Assets that increase the usefulness

Q146: A company used straight-line depreciation for an