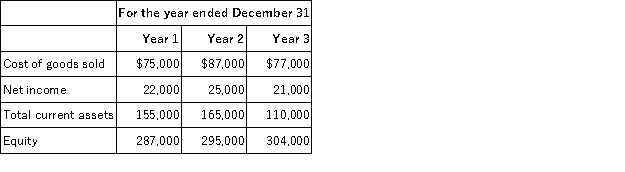

The Community Store reported the following amounts on their financial statements for Year 1,Year 2,and Year 3:  It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

It was discovered early in Year 4 that the ending inventory on December 31,Year 1 was overstated by $6,000,and the ending inventory on December 31,Year 2 was understated by $2,500.The ending inventory on December 31,Year 3 was correct.Ignoring income taxes determine the correct amounts of cost of goods sold,net income,total current assets,and equity for each of the years Year 1,Year 2,and Year 3.

Definitions:

Insurance Payment

Money paid to an insurance company for coverage, which can be in the form of premiums, deductibles, or copayments.

Claim Submitted

The process of requesting payment from an insurance company for healthcare services provided.

Medicare-Approved Amount

The predetermined cost that Medicare determines as reasonable for a medical service or supply, which sets the limit on what Medicare will pay and what you may be billed.

Ambulatory Payment Classification

A system used by Medicare and other health insurance programs to pay for outpatient services on a fixed rate based on the diagnosis and procedure rather than individual services provided.

Q43: Following are selected accounts and their balances

Q44: Austin's Pub Supply uses the periodic inventory

Q47: Assets,liabilities,and equity accounts are not closed;these accounts

Q68: On July 9,Mifflin Company receives a $8,500,90-day,8%

Q69: If a period-end inventory amount is reported

Q101: The Links Company uses the percent of

Q107: Cash,not including cash equivalents,includes:<br>A)Postage stamps.<br>B)Customer checks,cashier checks,and

Q109: Show the December 31 adjusting entry to

Q113: A company purchased land with a building

Q133: A machine had an original cost of