Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

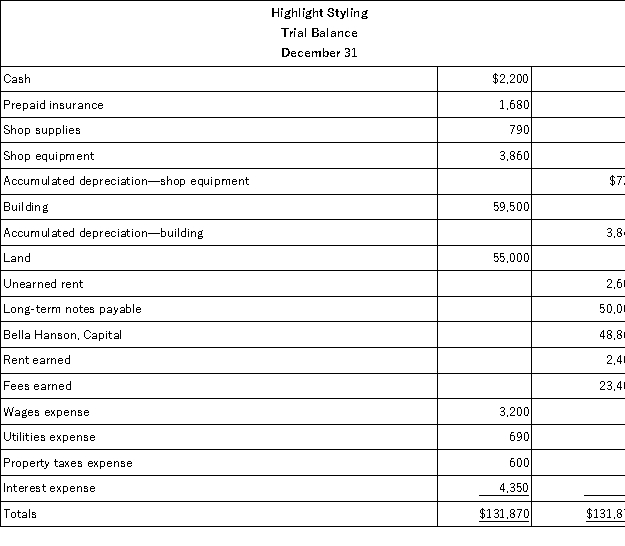

Highlight Stylings' unadjusted trial balance for the current year follows:  Additional information:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Content Validation

The process of evaluating the relevance and coverage of test items to ensure they accurately measure the desired construct.

Competency Modeling

A process for identifying and categorizing the knowledge, skills, and abilities required for effective performance in a job or organization.

Criterion-Related Validity

The extent to which a measure is related to an outcome, indicating the effectiveness of tests or procedures used in hiring or assessment processes.

Tectorial Membrane

A structure located in the cochlea of the inner ear, playing a key role in the process of sound transduction to the auditory nerve.

Q8: The financial statement that reports whether the

Q21: Which of the following accounting principles prescribes

Q35: Wiley Consulting purchased $7,000 worth of supplies

Q98: Accrual accounting and the adjusting process rely

Q108: Avanti purchases inventory from overseas and incurs

Q114: The _ method is commonly used to

Q124: Fill in the blanks (a)through (g)for the

Q137: Unearned revenue is classified as a(an)_ on

Q167: A revenue account normally has a debit

Q184: Accounting is an information and measurement system