Based on the unadjusted trial balance for Highlight Styling and the adjusting information given below,prepare the adjusting journal entries for Highlight Styling.

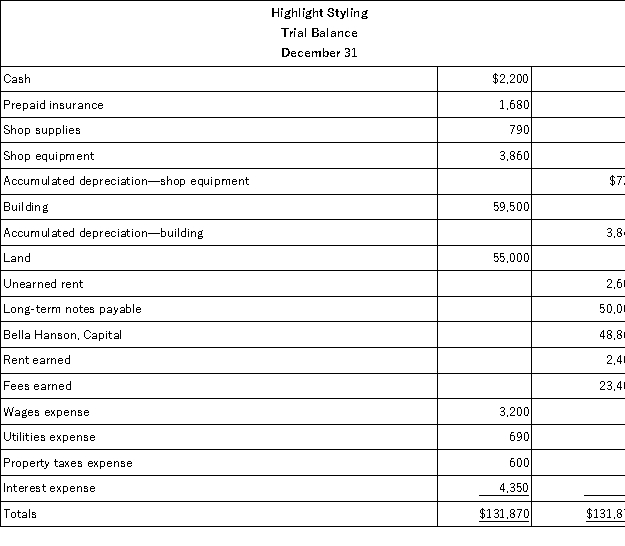

Highlight Stylings' unadjusted trial balance for the current year follows:  Additional information:

Additional information:

a.An insurance policy examination showed $1,040 of expired insurance.

b.An inventory count showed $210 of unused shop supplies still available.

c.Depreciation expense on shop equipment,$350.

d.Depreciation expense on the building,$2,020.

e.A beautician is behind on space rental payments,and this $200 of accrued revenues was unrecorded at the time the trial balance was prepared.

f.$800 of the Unearned Rent account balance was still unearned by year-end.

g.The one employee,a receptionist,works a five-day workweek at $50 per day.The employee was paid last week but has worked four days this week for which she has not been paid.

h.Three months' property taxes,totaling $450,have accrued.This additional amount of property taxes expense has not been recorded.

i.One month's interest on the note payable,$600,has accrued but is unrecorded.

Definitions:

Firm's Shares

Equity securities issued by a company, representing ownership in the firm and entitling holders to dividends and voting rights.

Creditors

People or organizations that provide loans or credit to others with the anticipation of receiving payment back later on.

NPVGO

Net Present Value of Growth Opportunities; a valuation method that calculates the present value of investment opportunities a company is expected to undertake in the future.

Above Average P/E Multiple

A valuation metric indicating that a company's current share price is higher relative to its per-share earnings than the industry or overall market average.

Q28: Quantum Corporation has provided the following data

Q37: In activity-based costing,low-volume complex products are usually

Q50: Flitter reported net income of $17,500 for

Q72: The area of accounting aimed at serving

Q104: Jefferson Company has sales of $300,000 and

Q109: When a company provides services for which

Q116: Prepare a December 31 balance sheet in

Q134: On December 15 of the current year,Conrad

Q171: A company's formal promise to pay (in

Q188: Identify the account below that is classified