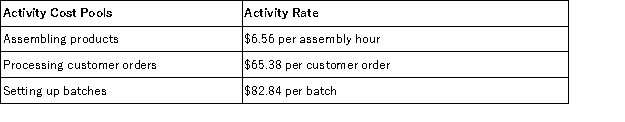

Mirkle Corporation uses the following activity rates from its activity-based costing to assign overhead costs to products:  Data for one of the company's products follow:

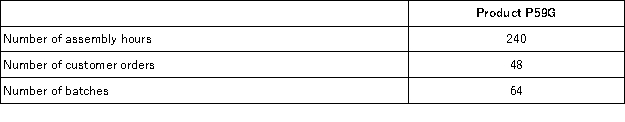

Data for one of the company's products follow:  The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much overhead cost would be assigned to Product P59G using the activity-based costing system?

The company produced 4,000 units of product during the period.Direct materials cost $7.30 per unit and direct labor cost $5.45 per unit.How much overhead cost would be assigned to Product P59G using the activity-based costing system?

Definitions:

DuPont Formula

A formula that breaks down Return on Equity into three parts: profitability, operating efficiency, and financial leverage, to analyze a company's financial health.

Profit Margin

A profitability ratio calculated as net income divided by revenue, showing the percentage of profit made from sales.

Income From Operations

The profit realized from a business's operational activities, calculated before taxes and interest are deducted.

Profit Margin

A financial metric that measures the percentage of revenue remaining after all expenses, taxes, and costs have been deducted.

Q35: Key questions proposed to use in analyzing

Q52: The purchase of supplies on credit should

Q61: _ is the process of allocating the

Q63: Research has shown that golden parachutes have

Q69: Which of the following is not an

Q72: Social audits can be thought of as

Q104: A common characteristic of _ is their

Q144: Identify the account below that is classified

Q150: For each of the following two separate

Q188: Identify the account below that is classified