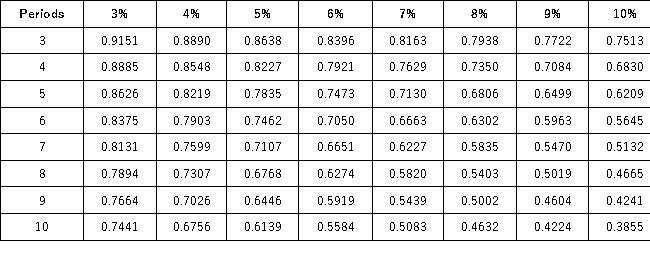

Present Value of 1  Future Value of 1

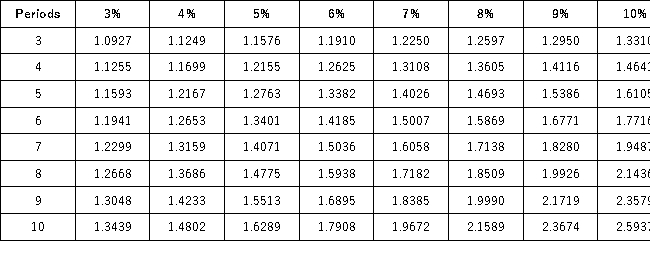

Future Value of 1  Present Value of an Annuity of 1

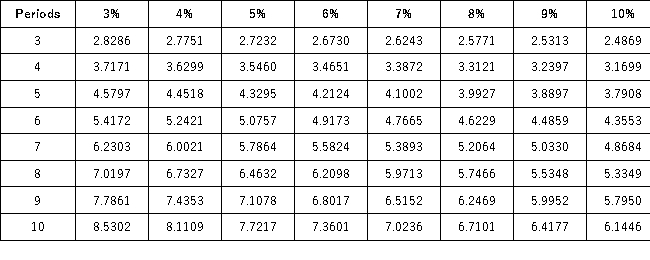

Present Value of an Annuity of 1  Future Value of an Annuity of 1

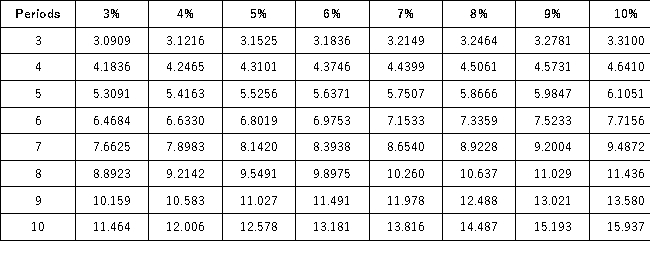

Future Value of an Annuity of 1  Marc Lewis expects an investment of $25,000 to return $6,595 annually.His investment is earning 10% per year.How many annual payments will he receive?

Marc Lewis expects an investment of $25,000 to return $6,595 annually.His investment is earning 10% per year.How many annual payments will he receive?

Definitions:

Availability Heuristic

A cognitive bias that causes people to overestimate the importance of information that is readily available to them.

Illusory Correlations

The belief in a connection between two factors when, in reality, no such connection is present.

Phonemes

The minimal sound component in a language that differentiates one word from another.

Morphemes

The smallest grammatical units in a language that carry meaning, such as prefixes, suffixes, and root words.

Q3: Mirkle Corporation uses the following activity rates

Q8: The financial statement that reports whether the

Q12: Which of the following is not a

Q20: When Tiger Woods crashed his Cadillac Escalade

Q22: Researchers have found that many business people

Q47: A sole proprietorship is a business owned

Q54: In making ethical judgments,it is usually easier

Q54: Prepare a December 31 balance sheet in

Q163: As a general rule,revenues should not be

Q170: If a company is highly leveraged,this means