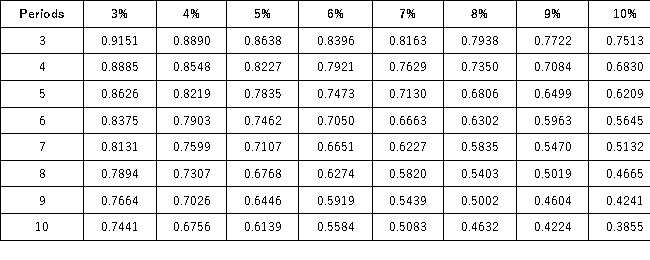

Present Value of 1  Future Value of 1

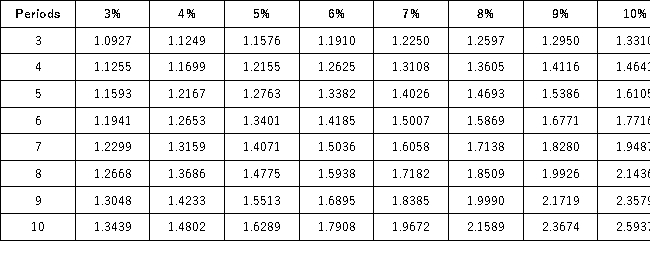

Future Value of 1  Present Value of an Annuity of 1

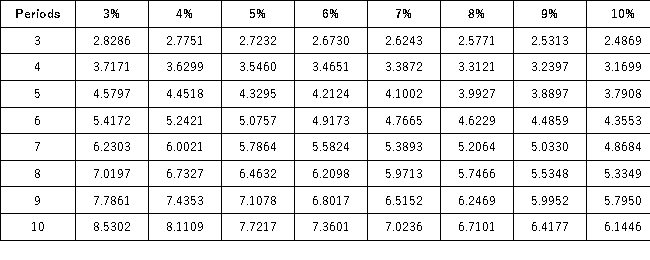

Present Value of an Annuity of 1  Future Value of an Annuity of 1

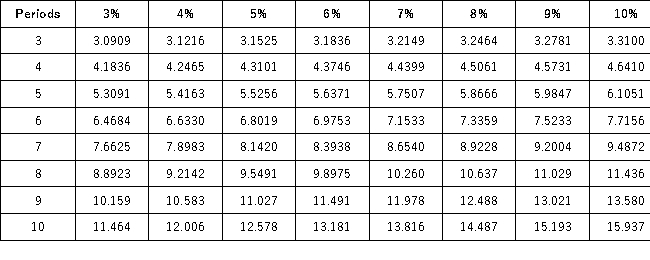

Future Value of an Annuity of 1  A company has $46,000 today to invest in a fund that will earn 4% compounded annually.How much will the fund contain at the end of 6 years?

A company has $46,000 today to invest in a fund that will earn 4% compounded annually.How much will the fund contain at the end of 6 years?

Definitions:

Reinforcement

In behavioral psychology, a process by which a behavior is strengthened or increased, often through rewards or consequences.

Cognitive Development

The process by which individuals acquire and understand knowledge through thought, experience, and the senses, encompassing learning, memory, problem-solving, and decision-making.

Assimilation

A cognitive process where individuals integrate new information into their existing knowledge base or framework.

Accommodation

A cognitive process in which an individual modifies existing cognitive schemas, perceptions, and understanding so that new information can be incorporated.

Q1: In most companies,issues management is done in

Q10: Because public affairs management often appears nebulous

Q13: Mirkle Corporation uses the following activity rates

Q18: Which of the following accounts is not

Q49: Which of the following is not a

Q58: Business organizations must address the legitimate needs

Q98: An owner's investment in a business normally

Q153: The question of when revenue should be

Q158: On January 1 of the current year,Jimmy's

Q207: The records of Roadmaster Auto Rentals show