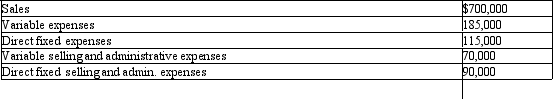

Figure 8-12. Assume the following information for a product line: Refer to Figure 8-12.What is the contribution margin of the product line?

Refer to Figure 8-12.What is the contribution margin of the product line?

Definitions:

Tax Rate

The percentage at which income or profits are taxed by the government.

Income Tax Liability

The amount of tax owed to the government for earnings made during a fiscal period.

Operating Income

The profit earned from a firm's core business operations, excluding deductions of interest and tax.

Tax Rate

The percentage at which an individual or corporation is taxed.

Q1: Psychologists disagree about the validity and effectiveness

Q20: A qualification that might ordinarily be argued

Q28: Which is not defined as a category

Q39: Russell Company uses Beltran Company and Southern

Q61: EAPs are designed to affmn all of

Q61: Activity elimination focuses on nonvalue-added activities.

Q84: _ assigns costs to activities and then

Q91: Which of the following statements is true?<br>A)The

Q110: The two categories of completed units needed

Q133: In a _ costs are accumulated by