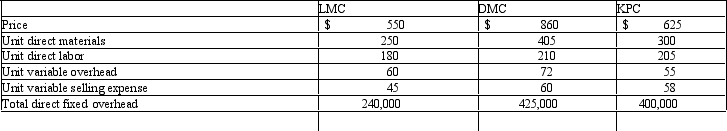

Mario Co.produces three products: LMC,DMC,KPC.For the coming year they expect to produce 160,000 units.Of these,65,000 will be LMC,40,000 will be DMC and 55,000 will be KPC.The following information was provided for the coming year:

Common fixed overhead is $984,000 and fixed selling and administrative expenses for Mario Co.is $881,000 per year.

Common fixed overhead is $984,000 and fixed selling and administrative expenses for Mario Co.is $881,000 per year.

Required:

A.Calculate the unit variable cost under variable costing.

B.Calculate the unit variable product cost.

C.Prepare a segmented variable-costing income statement for next year.

D.Should Mario Co.keep all product lines?

Definitions:

Demand Estimation

The process of determining the expected demand for a product or service, based on historical data, market trends, and statistical models.

Level Scheduling

A production strategy aiming to maintain a consistent production rate or workforce level over time, despite fluctuating demand.

Hire/Layoff Workers

Hiring and laying off workers are human resources management actions involving the appointment of new staff members and the dismissal of existing employees, respectively, usually based on the company’s current demand and financial situation.

Aggregate Planning

The method of creating, examining, and keeping an initial, rough plan of an organization's total activities.

Q24: Figure 6-4. The following information is available

Q41: Which of the following is not a

Q67: The following amounts were selected from the

Q81: Figure 9-3. Zion Company manufactures sneakers.Production of

Q85: Process costing is most appropriate for manufacturers

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5268/.jpg" alt=" Required:

Q106: Direct materials needed for production is calculated

Q138: The selling and administrative expenses budget includes<br>A)cost

Q153: The Thompson Company uses activity-based costing to

Q154: Figure 6-2. The Bing Corporation produces a