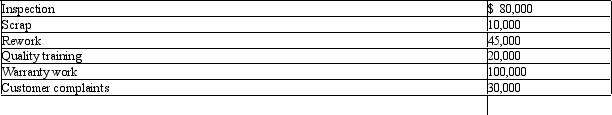

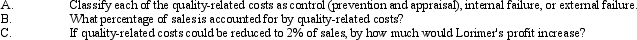

Lorimer Company had sales of $2,500,000 for last year.Data on quality-related costs for last year are as follows:

Definitions:

Tax Jurisdiction

The legal authority granted to a government entity to impose taxes on individuals, businesses, or transactions within a defined geographical area.

Permanent Differences

These are differences between taxable income and accounting income that originate in one period and do not reverse subsequently.

Deferred Tax Asset

A tax relief that results from over-payment or advance payment of taxes, which can be used to reduce a company's future tax liability.

Prepaid Asset

Expenses paid in advance for goods or services to be received in the future, which are recorded as assets until they are used or consumed.

Q29: Based on recent Supreme Court decisions,it is

Q74: Explain the history and purpose of the

Q75: The _ separates work and costs of

Q91: What are the three steps of overhead

Q104: Dance Unlimited plans to sell 10,000 ballet

Q106: Which of the following types of costs

Q110: Figure 9-9. Yummy Jams Company produces a

Q132: Figure 6-7. Geller Manufacturing uses a process

Q159: Sales mix is the relative combination of<br>A)inputs

Q162: Individual behavior that is in basic conflict