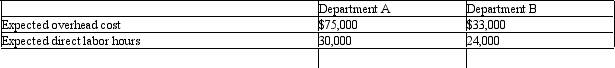

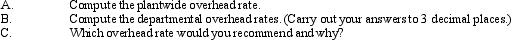

Feline Company uses a normal job-order costing system.Currently,a plantwide overhead rate based on direct labor is used.Lola Katz,the plant manager,has heard that departmental overhead rates can offer significantly better cost assignments than a plantwide rate can offer.Some jobs spend most of their time in Department A,while others spend most of their time in Department

B.Feline has the following data for its two departments for the coming year:

Definitions:

Weighted Average Cost

An inventory valuation method which assumes goods are used in the order in which they were purchased, often leading to a cost that is somewhere between the oldest and newest products.

Marginal Tax Rate

The tax rate that applies to each additional dollar of income earned; the percentage of tax paid on any additional income earned.

Capital Structure

The mix of a company's long-term debt, specific short-term debt, common equity, and preferred equity, which determines its financial leverage.

Pre-tax Cost

The expense associated with a resource or activity before the effect of taxes is considered.

Q20: See the following separate cases.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5268/.jpg"

Q27: Figure 4-2. Pauley Company provides home health

Q36: The following information is provided: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5268/.jpg"

Q59: In vertical analysis of the balance sheet,total

Q65: Simplicity is the main advantage of which

Q72: Any product or service that is basically

Q78: Figure 7-1. The receiving department of Owen

Q96: To calculate the equivalent units of production,the

Q100: Gross margin is the difference between sales

Q147: If a multi-product company simply wants to