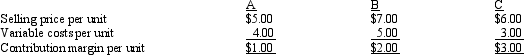

The following data pertain to the three products produced by Alberts Corporation:  Fixed costs are $90,000 per month.

Fixed costs are $90,000 per month.

Sixty percent of all units sold are Product A,30 percent are Product B,and 10 percent are Product C What is the monthly break-even point for total units?

Definitions:

Manufacturing Overhead

All manufacturing costs that are not directly attributable to a product’s production, such as indirect materials and labor.

Raw Materials

Fundamental materials in their raw, altered, or partially processed forms utilized as input for manufacturing.

Overhead Rate

A ratio used to allocate indirect costs to products or services, calculated by dividing total overhead costs by an allocation base, such as direct labor hours.

Direct Labor Cost

The total expense of employing workers who are directly involved in the production of goods, including wages and salaries.

Q38: Process costing is most useful in situations

Q46: Each unit of a product requires four

Q54: Large manufacturing plants,such as chemical,food,and tire manufacturers,use

Q75: Fidalgo Company makes stereos.During the year,Fidalgo manufactured

Q85: Marketing costs would be classified as period

Q87: Actual overhead costs are accumulated in the

Q108: Figure 5-14<br>Deluxe Design Company makes custom furniture.On

Q122: The presence of beginning and ending work-in-process

Q122: Brady Corporation has estimated overhead to be

Q155: Industrial statistics should be taken as absolute