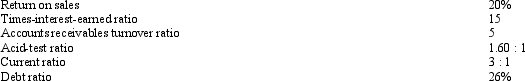

The following ratios have been computed for Gilbert Company for 2012.

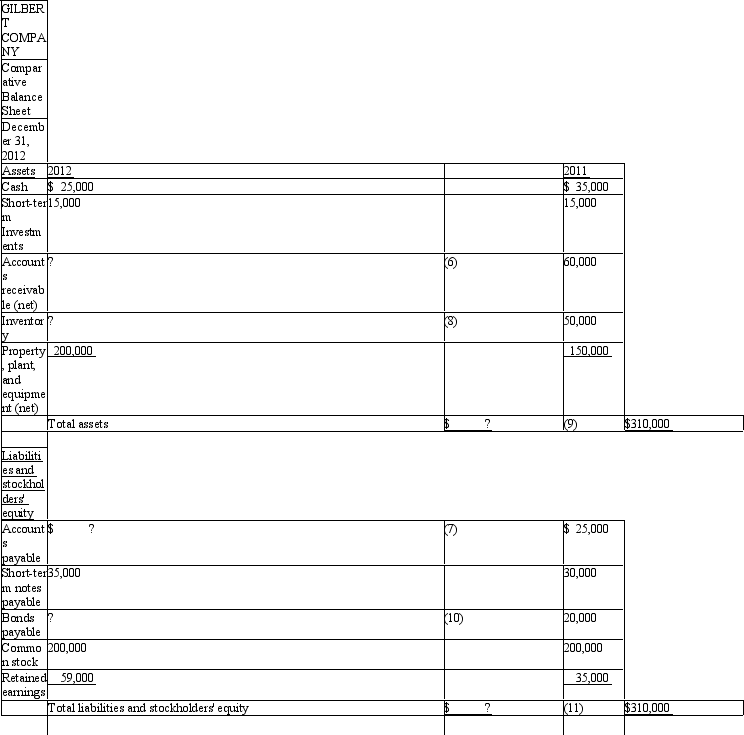

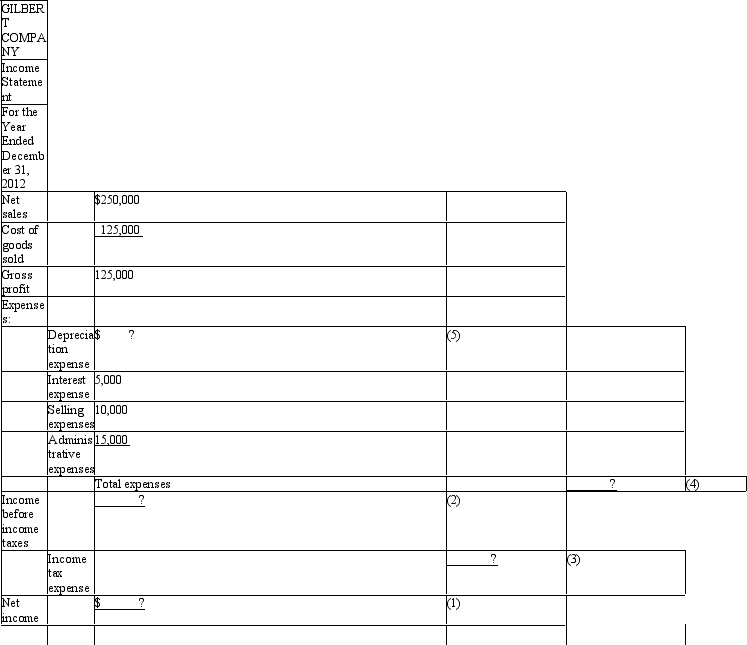

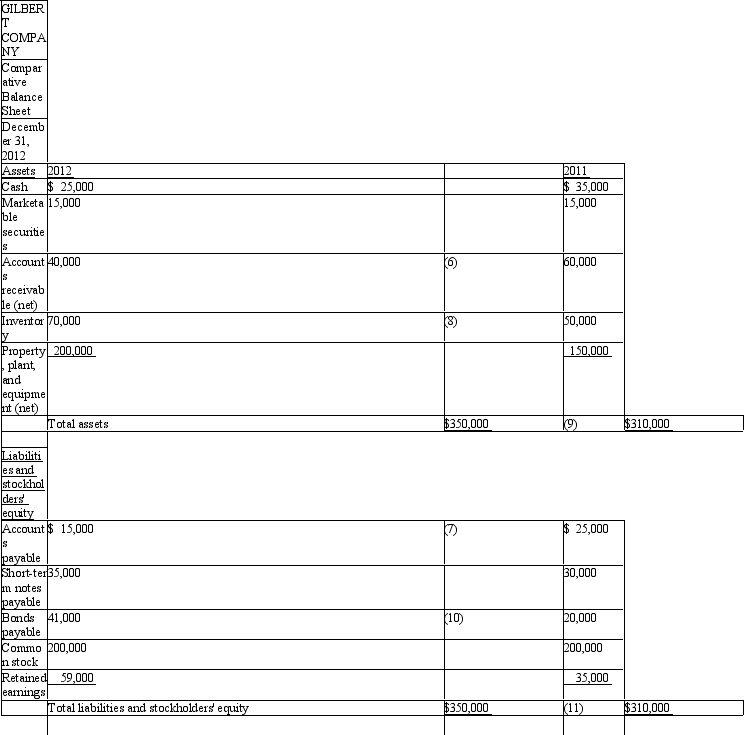

Gilbert Company's 2012 financial statements with missing information follow:

Gilbert Company's 2012 financial statements with missing information follow:

Required: Use the above ratios and information from the Gilbert Company financial statements to fill in the missing information on the financial statements.Follow the sequence indicated.Show computations that support your answers.

Required: Use the above ratios and information from the Gilbert Company financial statements to fill in the missing information on the financial statements.Follow the sequence indicated.Show computations that support your answers.

Definitions:

Depreciation

The process of methodically allocating the expense of a physical asset over its functional life.

Sales Price

The amount at which goods or services are sold to customers, sometimes before discounts, taxes, or additional charges.

Equipment Cost

The total expense incurred in purchasing and preparing equipment for its intended use, including acquisition, delivery, and setup costs.

Land Account

An account in the financial statements that tracks the cost of land owned by a company.

Q20: See the following separate cases.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5268/.jpg"

Q31: Which profitability ratio requires the use of

Q64: The difference between the present value of

Q73: Phillips Company had $300,000 in sales on

Q77: _ and _ are the two major

Q109: Earnings per share is an indication of

Q128: Rose Manufacturing Company had the following unit

Q131: The operations of Knickers Corporation are divided

Q136: Figure 16-6<br>London Company provided the following income

Q159: An investment of $5,000 provides an average