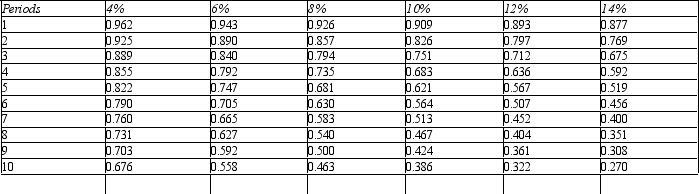

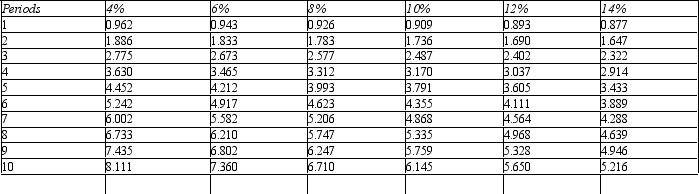

Figure 14-10.

Present value of $1

Present value of an Annuity of $1

Present value of an Annuity of $1

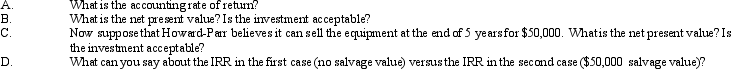

Refer to Figure 14-10.Howard-Parr Company is considering an investment that will have an initial cost of $500,000 and yield annual net cash inflows of $130,000.Yearly depreciation will be $100,000.The equipment is expected to be useful for five years,at which point it will be scrapped with no salvage value.Howard-Parr requires a minimum rate of return of 10 percent.

Refer to Figure 14-10.Howard-Parr Company is considering an investment that will have an initial cost of $500,000 and yield annual net cash inflows of $130,000.Yearly depreciation will be $100,000.The equipment is expected to be useful for five years,at which point it will be scrapped with no salvage value.Howard-Parr requires a minimum rate of return of 10 percent.

Definitions:

Honeymoon Phase

A period of time during which a couple experiences an intense and often idealized emotional connection, commonly at the beginning of a relationship.

Acute Battering

A severe form of physical violence or abuse in a domestic setting, typically leading to immediate physical and emotional trauma.

Nursing Diagnosis

A clinical judgment about individual, family, or community responses to actual or potential health problems, forming the basis for selecting nursing interventions.

Intimate Partner Violence

Abuse or aggression that occurs in a romantic relationship, encompassing physical, sexual, emotional, or psychological harm by a current or former partner.

Q5: The _ computes operating cash flow by

Q8: The practice of delegating decision-making authority to

Q64: The _ is computed by dividing a

Q80: An advantage to using a worksheet to

Q81: Figure 14-4. Sony Lavery is considering investing

Q86: Harry Company's standard variable overhead rate is

Q97: Figure 13-7. Ring Company makes telephones.Currently,Ring makes

Q98: Figure 13-4. Connolly Company produces two types

Q118: Which of the following relationships is valid

Q125: Which of the following would be added