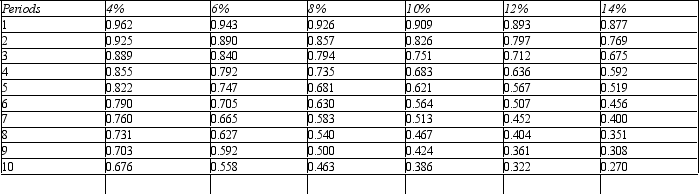

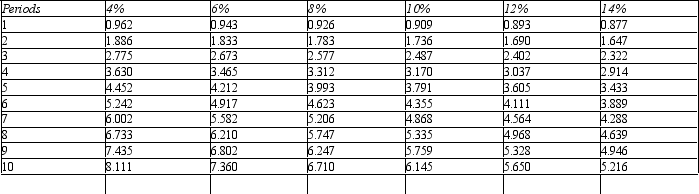

Figure 14-10.

Present value of $1

Present value of an Annuity of $1

Present value of an Annuity of $1

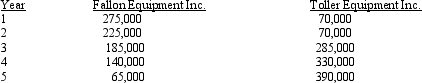

Refer to Figure 14-10.Ray Corporation is looking to invest in a new piece of equipment.Two manufacturers of this type of equipment are being considered.After-tax inflows for the two competing projects are:

Refer to Figure 14-10.Ray Corporation is looking to invest in a new piece of equipment.Two manufacturers of this type of equipment are being considered.After-tax inflows for the two competing projects are:

Both projects require an initial investment of $400,000.In both cases,assume that the equipment has a life of five years with no salvage value.

Both projects require an initial investment of $400,000.In both cases,assume that the equipment has a life of five years with no salvage value.

Required:

A.Assuming a discount rate of 8 percent,compute the net present value of each piece of equipment.

B.A third option is now available for a supplier outside of the country.The cost is also $400,000,but it will produce even cash flows over its five-year life.What must the annual cash flow be for this equipment to be selected over the other two? Assume an 8 percent discount rate.

Definitions:

Menstruating

The monthly biological process in females of reproductive age where the lining of the uterus sheds, accompanied by bleeding, marking a normal reproductive cycle.

Generalized Anxiety Disorder

Disorder in which a person has feelings of dread and impending doom along with physical symptoms of stress, which lasts 6 months or more.

Biological Perspective

An approach to psychology focusing on physical and biological bases of behavior, including genetic, hormonal, and neurophysiological processes.

Amygdala

Brain structure located near the hippocampus, responsible for fear responses and memory of fear.

Q6: An activity-based budgetary approach can be used

Q11: Figure 14-7. Osler Company is considering an

Q33: Pasha Company produced 50 defective units last

Q51: Barker Production Company is considering the purchase

Q59: The Bayou Company makes crab pots.During the

Q61: Which one of the following would not

Q83: Figure 15-1. Master Company's net income last

Q103: Brenning Company invested $3,000,000 in a new

Q104: The data given below are from the

Q123: At split-off,the joint costs of production for