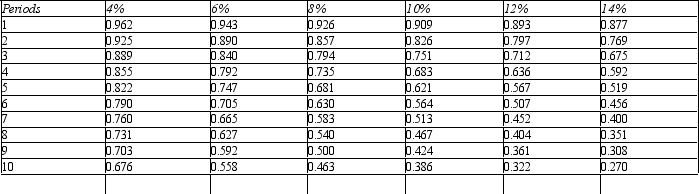

Figure 14-10.

Present value of $1

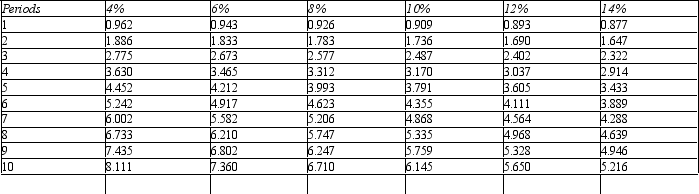

Present value of an Annuity of $1

Present value of an Annuity of $1

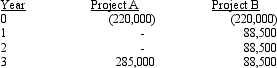

Refer to Figure 14-10.Durrel Company is considering two different modifications to its current manufacturing process.The after-tax cash flows associated with the two investments are as follows:

Refer to Figure 14-10.Durrel Company is considering two different modifications to its current manufacturing process.The after-tax cash flows associated with the two investments are as follows:

Durrel's cost of capital is 6 percent.

Durrel's cost of capital is 6 percent.

Required:

A.Compute the NPV for each investment and state which project should be chosen based on the NPV.

B.Compute the IRR for each investment and state which project should be chosen based on the IRR.

Definitions:

Wall Paint Colors

Refers to the spectrum of colors available for use in painting interior or exterior walls, often used to influence mood and perception of space.

One-Way ANOVA

A statistical test that compares the means of three or more independent groups to determine if there is a significant difference between them.

Null Hypothesis

The default hypothesis that there is no significant difference or relationship between specified populations, any observed effect is due to sampling or experimental error.

Interaction

In the context of statistics and experimental design, interaction refers to a situation where the effect of one independent variable on the dependent variable varies according to the level of another independent variable.

Q18: Figure 15-2. Chandler Company's net income last

Q31: Figure 13-8. Kerrigan Lumber Yard receives 12,000

Q38: All firms that are registered with the

Q59: Figure 13-9. Sabor Inc.is a medical testing

Q59: The Bayou Company makes crab pots.During the

Q96: The Dear Division of Zimmer Company sells

Q117: List and describe the three categories of

Q130: In vertical analysis,line items on the balance

Q138: Dixie Company has the following data for

Q141: Which of the following is true regarding