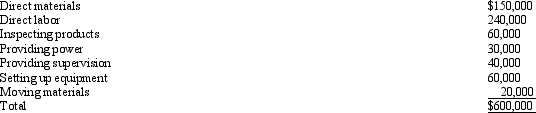

Foster Industries manufactures 20,000 components per year.The manufacturing cost of the components was determined as follows:  If the component is not produced by Foster,inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount.An outside supplier has offered to sell the component for $25.50.

If the component is not produced by Foster,inspection of products and provision of power costs will only be 10% of the current production costs; moving materials costs and setting up equipment costs will only be 50% of the production costs; and supervision costs will amount to only 40% of the production amount.An outside supplier has offered to sell the component for $25.50.

What is the effect on income if Foster Industries purchases the component from the outside supplier?

Definitions:

Polysemy

The phenomenon wherein a word, term, or symbol has multiple meanings or interpretations.

Violent And Horrific

Violent and horrific describes actions or events that are extremely brutal, causing fear, shock, or disgust.

Alternative Interpretation

A different or unconventional way of understanding or explaining something, often challenging the more widely accepted views or theories.

Polysemy

The phenomenon where a word or phrase has multiple meanings or interpretations.

Q4: Figure 10-2. Highland Company's standard cost

Q6: An activity-based budgetary approach can be used

Q8: Short-run decision making only involves short-run decisions

Q26: Activity flexible budgeting provides a more accurate

Q41: If the internal rate of return (IRR)is

Q54: Figure 11-4. Kris Company calculates its predetermined

Q83: Figure 15-1. Master Company's net income last

Q131: Figure 15-1. Master Company's net income last

Q135: Paige Inc.has a division that makes paint

Q145: The two variances for variable overhead are<br>A)spending