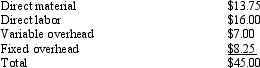

Tapeo Company has always made its electronic components that go into their GPS systems in-house.Streeter Company has offered to supply these electronic components at a price of $38 each.Tapeo uses 18,000 units of these components each year.The cost per unit of this component is as follows:

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Assume that 45% of Tapeo Company's fixed overhead would be eliminated if the electronic component was no longer produced in-house.

Required:

A.If Tapeo decided to purchase the electronic component from Streeter Company how much would its operating income increase or decrease?

B.Should Tapeo continue to make the electronic component or buy it from Streeter Company?

Definitions:

State Unemployment Taxes

Taxes imposed by state governments on employers to fund unemployment insurance benefits for laid-off workers.

Hourly Wage Rate

The amount of money paid for each hour of work performed.

Federal Income Tax Withholding

Federal income tax withholding is the process by which an employer deducts a portion of an employee's income to pay directly to the federal government as a prepaid credit towards the employee’s annual tax liability.

Contingent Liabilities

Potential obligations that may arise from past events, depending on the outcome of future events.

Q15: One disadvantage of the payback period is

Q15: The following costs were developed for one

Q52: The Exchange Company is in the process

Q55: A follow-up analysis of a capital investment

Q55: Figure 11-3. Montgomery Company has developed the

Q89: Fastlane Company has 50,000 shares of common

Q96: Companies can use two different methods to

Q120: If actual fixed overhead was $98,400 and

Q122: The _ focuses on the estimation of

Q131: The operations of Knickers Corporation are divided