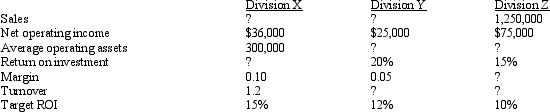

The following information pertains to the three divisions of Marlow Company:  What is the residual income for Division X?

What is the residual income for Division X?

Definitions:

Cost of Merchandise Sold

The total cost incurred by a company to sell its products, including the cost of the goods themselves plus any additional expenses.

Sales Tax

A tax on sales or on the receipts from sales, typically added to the purchase price by the seller.

Gross Profit

The difference between revenue and the cost of goods sold before deducting overhead, payroll, taxation, and interest payments.

Selling Expenses

Expenses that are incurred directly in the selling of merchandise.

Q15: One disadvantage of the payback period is

Q37: You decide<br>Explain the three potential sources of

Q55: The direct comparison of the performance of

Q56: A responsibility center in which a manager

Q57: The Auto Division of Big Department Store

Q60: Which of the following is an example

Q62: Which of the following is an absolute

Q69: _ are simply those factors that are

Q130: Billings Office Services is considering the purchase

Q131: Figure 11-1. Jason,Inc.produces leather purses.Jason has developed