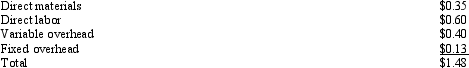

Figure 12-3. Grey Inc.has many divisions that are evaluated on the basis of ROI.One division,Centra,makes boxes.A second division,Mantra,makes chocolates and needs 80,000 boxes per year.Centra incurs the following costs for one box: Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Refer to Figure 12-3.Assume that Grey Inc.allows division managers to negotiate transfer price.Centra is producing 600,000 boxes.If Centra and Mantra agree to transfer boxes,what is the floor of the bargaining range and which division sets it?

Definitions:

Excise Tax

A tax applied to specific goods, services, or transactions, usually with the intent of discouraging their use or generating revenue.

Tax Per Unit

A specific tax levied on a product based on the number of units purchased, not the value of the purchase.

Efficiency Loss

The loss of economic efficiency that can occur when equilibrium for a good or a service is not achieved or is not achievable.

Q7: In a standard cost system,variable overhead is

Q32: Stratford Company inspects every steam iron it

Q44: Figure 10-4. High Fliers Company produces model

Q46: Perfect Builders makes all sorts of moldings.Its

Q48: Boone Products had the following unit costs:

Q71: The usage variance is the difference between

Q73: A postaudit evaluates the overall outcome of

Q79: Target costing is a method of determining

Q79: In setting price standards for materials and

Q151: Piersall Company makes a variety of paper