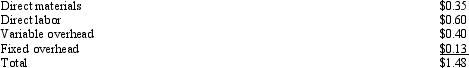

Figure 12-3. Grey Inc.has many divisions that are evaluated on the basis of ROI.One division,Centra,makes boxes.A second division,Mantra,makes chocolates and needs 80,000 boxes per year.Centra incurs the following costs for one box: Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Centra has capacity to make 700,000 boxes per year.Mantra currently buys its boxes from an outside supplier for $1.80 each (the same price that Centra receives) .

Refer to Figure 12-3.Assume that Grey Inc.mandates that any transfers take place at full manufacturing cost.What would be the transfer price if Centra transferred boxes to Mantra?

Definitions:

Bank

A financial institution licensed to receive deposits, offer loans, and provide other financial services.

Accounts Payable

Short-term liabilities of a company, representing amounts owed to suppliers or creditors for goods and services received but not yet paid for.

Computer

An electronic device capable of manipulating data or information, allowing for storage, retrieval, and processing to perform various tasks.

Capital

The financial resources available for use, such as cash, goods, or property, invested to create profit.

Q9: The _ is a way to see

Q14: Figure 11-4. Kris Company calculates its predetermined

Q42: Which of the following would be an

Q43: Moss Company charges cost plus 35%.What is

Q53: Managerial accounting strongly emphasizes providing information about

Q60: Figure 10-3. Bortello Corporation produces high-quality leather

Q73: Responsibility for variable overhead spending and efficiency

Q75: Cash flows from operating activities can be

Q105: Gina Production Company uses a standard costing

Q145: Which of the following is a reason