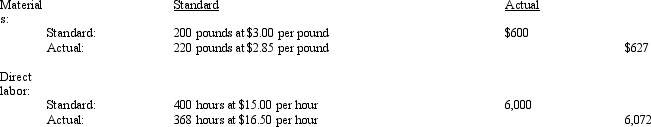

Bender Corporation produced 100 units of Product AA.The total standard and actual costs for materials and direct labor for the 100 units of Product AA are as follows:  What is the labor efficiency variance for Bender Corporation?

What is the labor efficiency variance for Bender Corporation?

Definitions:

Roth IRA

Deposits are taxable, but when the money is withdrawn after having been there for at least 5 years and the saver is at least 59 1/2 years old, the money and the income earned is tax-exempt, or free from all taxes.

Tax-Deferred

Taxes are paid at the time the money is withdrawn from the account, not when the money is actually earned.

Social Security Benefits

Payments made to eligible individuals (retirees, disabled workers, and their families) from the Social Security program, funded by Social Security taxes.

Need-Based

A criteria or qualification that is determined by the applicant's financial need or income level, often used for financial aid or grants.

Q1: One gene therapy that does not rely

Q5: Neoantigens are_ .<br>A)mutations that are silent<br>B)mutations that

Q41: Which of the following is not a

Q48: Activity-based budgeting begins with the _ and

Q60: Figure 10-3. Bortello Corporation produces high-quality leather

Q78: During June,Cisco Company produced 12,000 chainsaw blades.The

Q106: The level of the transfer price can

Q123: Pontefract Company produced 2,500 widgets during November

Q126: Arcadia Company incurred the following costs and

Q140: Fester Company was making a product for