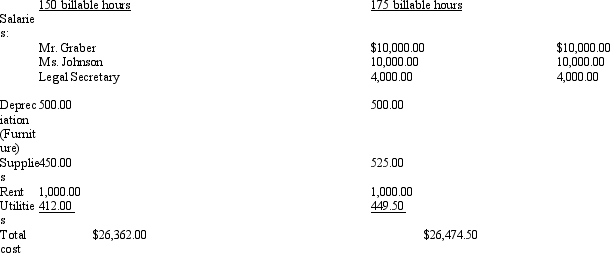

Graber and Johnson,Attorney's at Law,recently opened a law practice in the Northwest.Their goal is to generate a monthly net income of $10,000.They have initially set their billing rate at $150 per hour.Their billable hours in the first month of operations (January)were 150 and in the second month of operations (February),175 billable hours.The costs incurred at these levels for January and February are given below.

Definitions:

Taxable Income

The amount of an individual's or entity's income used to determine how much tax is owed, calculated as gross income minus deductions and exemptions.

Monthly Salary

The amount of money an employee is paid each month for their job performance, not including bonuses or overtime pay.

Net Pay

The amount of an employee's earnings after all deductions, such as taxes and retirement contributions, have been removed.

FICA Tax

The Federal Insurance Contributions Act (FICA) tax is a payroll tax in the United States that is required from both employers and employees to support Social Security and Medicare programs.

Q17: In 2015,a group of Chinese researchers used

Q17: Haploinsufficiency refers to_ .<br>A)the genetic predisposition for

Q19: If an F2 generation from a self-

Q19: Type II CRISPR- Cas systems are the

Q24: Figure 3-7. Margola Company produces hand-held calculators.The

Q42: Once an exogenous foreign piece of DNA

Q85: Figure 10-9. James Company manufactures t-shirts.During the

Q106: Kaizen costing involves:<br>A)changing the standards frequently.<br>B)changing management.<br>C)outsourcing

Q171: Margolo Company makes cross-country skis.The company controller

Q173: The relevant range is the range of