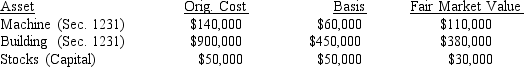

Casey Corporation has three assets when it decides to liquidate:  The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

Definitions:

Country Contexts

The unique combination of social, economic, political, and cultural factors that characterize each country and influence business operations and strategies.

Global Leadership Ability

The capability to influence and guide individuals or groups from different countries towards achieving organizational goals.

Expatriate

An individual living and working in a country other than their country of citizenship, often temporarily and for work reasons.

Company-Related Competencies

The unique skills, resources, and capabilities that give an organization competitive advantage in its industry or market.

Q4: All of the following are primary sources

Q15: Organisms that are well understood from a

Q16: _ 4.Employers must withhold the Medicare surtax

Q17: Soho is a personal service corporation that

Q20: All of the following apply to the

Q22: What is meant by the term heterogeneous

Q22: _ 4.The holding period for boot in

Q24: Modular portions of a protein that fold

Q30: DNA replication proceeds_ .<br>A)discontinuously<br>B)progressively<br>C)semiconservatively<br>D)dispersively<br>E)unidirectionally

Q54: What is Colin's deduction for taxes?<br>A)$8,700<br>B)$7,500<br>C)$5,400<br>D)$2,100