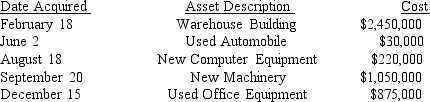

Table 1: Sanjuro Corporation (a calendar-year corporation)purchased and placed in service the following assets during 2013:

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

-Refer to the information in Table 1.What is Sanjuro Corporation's maximum total cost recovery deduction for 2013?

a.$512,550

b.$1,193,830

c.$1,731,707

d.$2,175,000

Definitions:

Exchange Rate

How much one currency is worth in terms of another during exchange.

Euros

The official currency of 19 of the 27 European Union countries, known as the Eurozone.

Corn Laws

A series of laws in the 19th century Britain that imposed restrictions and tariffs on imported grain to protect domestic grain producers.

Imports

Goods and services bought by a country from another country, contributing to international trade.

Q11: Which of these persons never pays taxes

Q13: The _ Act specifically requires employers to

Q19: The concept that management is guaranteed the

Q21: Describe the techniques supervisors can implement to

Q23: _ 1.The Internal Revenue Service is part

Q28: _ 9.Once established at entry,a partner's basis

Q32: The creation of horizontal (departments)and vertical levels

Q37: In many species,there are two representatives of

Q40: The best safety rules and regulation will

Q48: Which of the following is not a