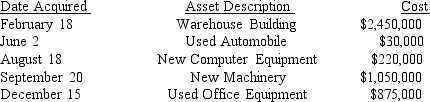

Table 1: Sanjuro Corporation (a calendar-year corporation) purchased and placed in service the following assets during 2013:

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

All assets are used 100% for business use.The warehouse building does not include the cost of the land on which it is located which was an additional $1,000,000.The corporation has $3,000,000 income from operations before calculating depreciation deductions.Sanjuro Corporation wishes to maximize its overall depreciation deduction for 2013 and is willing to make any necessary elections.

-Refer to the information in Table 1.What is Sanjuro Corporation's cost recovery deduction for the automobile for 2016 assuming the necessary elections were made to maximize overall depreciation in 2013?

Definitions:

Income Elasticities

Income elasticities measure how the quantity demanded of a good changes in response to a change in consumers' income.

Normal Goods

Goods for which demand increases as consumer income rises, and decreases as consumer income falls.

Inferior Goods

Goods for which demand decreases as consumer income rises, in contrast to normal goods, where demand increases with higher incomes.

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, reflecting the sensitivity of consumers to price changes.

Q4: _ 6.To qualify as head of household,the

Q11: When you are engaged in distributive bargaining,your

Q12: George is allowed to buy fringe benefits

Q13: Research finds that champions have common personality

Q16: One of the most well documented findings

Q31: Elizabeth exchanges her retail storage assets for

Q38: _ 4.A calendar year always ends on

Q44: What are the carryover provisions for unused

Q55: An individual may apply for an automatic

Q59: _ 23.Qualifying low income wage earners may