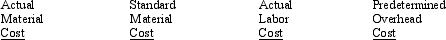

Which of the following costing methods of valuation are acceptable in a job-order costing system?

Definitions:

Indirect Method

A cash flow statement approach that adjusts net income for changes in non-cash working capital and non-operating adjustments to calculate cash flow from operations.

Operating Activities

Transactions and other events that are not investing or financing activities, contributing to the company's primary operations and cash flow.

Direct Method

A way to present the cash flow from operating activities by listing major operating cash receipts and payments, making it easier to understand than the indirect method.

Operating Activities

Day-to-day actions that relate directly to the production, sale, and delivery of a company’s products and services.

Q11: A loss that occurs uniformly throughout a

Q16: In a normal cost system,a debit to

Q64: O'Brien Corporation applies overhead at the rate

Q65: List and explain the six steps of

Q67: An operations flow document shows all processes

Q83: When cost driver analysis is used,organizational profit

Q83: If overapplied factory overhead is immaterial,the account

Q88: Averaging the total cost of completed beginning

Q103: Stone Company Stone Company produces 50,000 units

Q119: A company that manufactures small quantities of