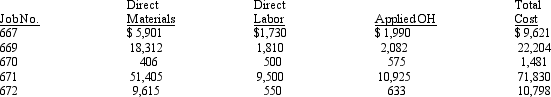

Parker Company manufactures custom-built conveyor systems for factory and commercial operations.Susan Jones is the cost accountant for Parker Company and she is in the process of educating a new employee,Terry Smith about the job-order costing system that Parker Company uses.(The system is based on normal costs; overhead is applied based on direct labor cost and rounded to the next whole dollar.)The following job-order cost records are available for July:

To explain the missing job number,Susan informed Terry that Job #668 had been completed in June.She also told her that Job #667 was the only job in process at the beginning of July.At that time,the job had been assigned $4,300 for direct material and $900 for direct labor.At the end of July,Job #671 had not been completed; all others had.Terry asked Susan several questions to determine whether she understood the job-order system.

To explain the missing job number,Susan informed Terry that Job #668 had been completed in June.She also told her that Job #667 was the only job in process at the beginning of July.At that time,the job had been assigned $4,300 for direct material and $900 for direct labor.At the end of July,Job #671 had not been completed; all others had.Terry asked Susan several questions to determine whether she understood the job-order system.

Required: Help Susan answer the following questions:

Definitions:

Cost-Of-Living Adjustments

Wage or salary increases based on changes in the cost of living, ensuring purchasing power is maintained.

Performance Measures

Metrics or indicators used to assess the effectiveness, quality, and efficiency of an individual's or organization's work.

Profit-Sharing

A company policy of sharing a portion of its profits with employees, usually in addition to their normal salaries or wages.

Gain Sharing

A performance-related pay plan that gives employees incentives based on improvements in company performance, such as increased productivity or profitability.

Q13: Machine setup is normally considered a unit-level

Q29: Contero Products has no Work in Process

Q30: Truman Company<br>Truman Company applies overhead based on

Q77: Guthrie Corporation The following information is available

Q80: The FIFO method separates beginning inventory and

Q91: Fixed cost per unit varies directly with

Q130: Cayton Company.<br>Cayton Company uses a job-order costing

Q132: A company that manufactures large quantities of

Q136: A chart that indicates each step in

Q193: Fleetwood Company Fleetwood Company uses a