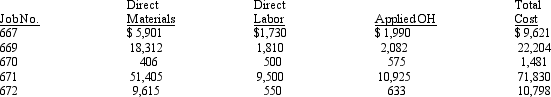

Parker Company manufactures custom-built conveyor systems for factory and commercial operations.Susan Jones is the cost accountant for Parker Company and she is in the process of educating a new employee,Terry Smith about the job-order costing system that Parker Company uses.(The system is based on normal costs; overhead is applied based on direct labor cost and rounded to the next whole dollar.)The following job-order cost records are available for July:

To explain the missing job number,Susan informed Terry that Job #668 had been completed in June.She also told her that Job #667 was the only job in process at the beginning of July.At that time,the job had been assigned $4,300 for direct material and $900 for direct labor.At the end of July,Job #671 had not been completed; all others had.Terry asked Susan several questions to determine whether she understood the job-order system.

To explain the missing job number,Susan informed Terry that Job #668 had been completed in June.She also told her that Job #667 was the only job in process at the beginning of July.At that time,the job had been assigned $4,300 for direct material and $900 for direct labor.At the end of July,Job #671 had not been completed; all others had.Terry asked Susan several questions to determine whether she understood the job-order system.

Required: Help Susan answer the following questions:

Definitions:

Independent Variables

Variables in an experiment that are manipulated or changed to observe their effect on the dependent variables.

Manipulated

Being controlled or influenced in a deceitful way, often without being aware of it, which can affect behavior and decision-making.

Audio-CASI Method

An interviewing technique using audio computer-assisted self-interviewing to enhance privacy and reduce bias.

Interviewing Research Technique

A method used in qualitative research that involves conducting in-depth interviews to gather detailed information.

Q39: Sales less variable cost of goods sold

Q62: Jordan Company The following information has been

Q66: A mixed cost will be an effective

Q91: Fixed cost per unit varies directly with

Q111: Conversion cost does not include<br>A)direct labor.<br>B)direct material.<br>C)factory

Q151: Non-value-added activities that are necessary to businesses,but

Q167: Direct materials are normally considered batch-level costs.

Q171: Webb Company. Webb Company uses a job-order

Q176: Weaknesses of the high-low method include all

Q198: Fleetwood Company Fleetwood Company uses a