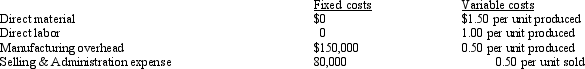

Kellman Corporation Kellman Corporation produces a single product that sells for $7.00 per unit.Standard capacity is 100,000 units per year; 100,000 units were produced and 80,000 units were sold during the year.Manufacturing costs and selling and administrative expenses are presented below.

There were no variances from the standard variable costs.Any under- or overapplied overhead is written off directly at year-end as an adjustment to cost of goods sold. Kellman Corporation had no inventory at the beginning of the year.

Kellman Corporation had no inventory at the beginning of the year.

Refer to Kellman Corporation.In presenting inventory on the balance sheet at December 31,the unit cost under absorption costing is

Definitions:

Rate of Return

A financial metric used to measure the profit or loss of an investment relative to its initial cost.

Cross-Dock Facility

A logistics strategy where incoming materials are unloaded directly from suppliers' trucks and immediately loaded onto outbound trucks, reducing storage time and costs.

Operating Costs

Expenses associated with the day-to-day functioning of a business, excluding the cost of goods sold.

High Demand

A condition in which the need or market request for a product or service surpasses usual or anticipated levels.

Q17: A benchmarking process that is non-industry specific

Q20: Austin Company The following information is available

Q33: Which of the following costing systems allows

Q57: Which of the following are categories judged

Q67: Cayton Company.<br>Cayton Company uses a job-order costing

Q82: For a company that manufactures candy,how would

Q90: Oakwood Corporation Oakwood Corporation produces a single

Q170: The journal entry to record the incurrence

Q172: Cost allocation bases in activity-based costing should

Q177: At the end of the last fiscal