On December 30,a fire destroyed most of the accounting records of the Alcorn Division,a small one-product manufacturing division that uses standard costs and flexible budgets.All variances are written off as additions to (or deductions from)income; none are pro-rated to inventories.You have the task of reconstructing the records for the year.The general manager informs you that the accountant has been experimenting with both absorption costing and variable costing.

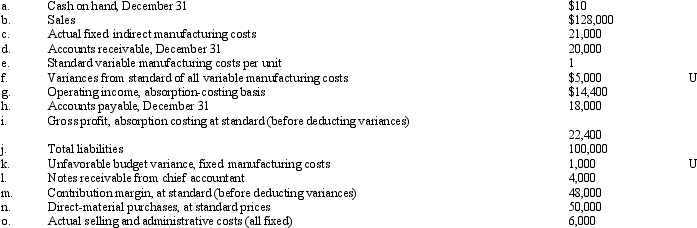

The following information is available for the current year:

Required:

Required:

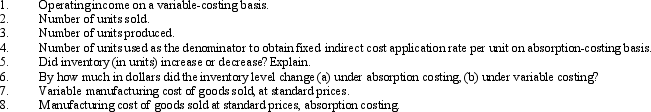

Compute the following items (ignore income tax effects).

Definitions:

Implicit Costs

Costs that represent the loss of potential income from resources when they are not utilized in their best alternative use.

Opportunity Cost

Forgoing possible gains from various alternatives by picking a specific one.

Personal Savings

The portion of an individual's income that is not spent on consumption and is saved for future expenses, investments, or emergencies.

Explicit Cost

Direct, out-of-pocket payments for the purchase of inputs or resources for business operations.

Q24: Ada National Bank Ada National Bank had

Q39: A formula that indicates the optimal number

Q45: Greensboro Corporation<br>Greensboro Corporation is a manufacturer of

Q46: Consider the regression equation y = a

Q55: What is data mining and how is

Q57: In which life-cycle stage are product quality

Q63: In allocating variable costs to products,<br>A)a volume-based

Q65: Which of the following is not a

Q105: At the end of the last fiscal

Q199: Variable costing has an advantage over absorption